Power Sector Construction Costs Surge

From the April 2008 issue of EEnergy Informer.

Construction costs rise significantly just as the demand for power grows

With demand for electricity outstripping available capacity in many parts of the world, the power sector is on a rapid expansion mode. In developing countries like India and China, chronic power shortages are crippling economic growth. South Africa, once blessed with ample supplies and cheap electricity has been resorting to power rationing until new capacity can be brought on line, perhaps by 2013. In developed countries, an aging infrastructure needs to be replaced while confronting rising fuel costs and concerns about global climate change.

Now comes another worry: an unprecedented rise in construction costs. Everything needed to build a power plant or a transmission line, it seems, costs a lot more than it did only a year or two ago, including raw material, customized fabricated parts and components and, of course, labor and transportation costs.

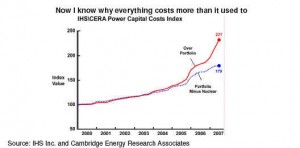

The evidence is mostly anecdotal, but appears pervasive. A new Power Capital Cost Index (PCCI), developed by IHS Inc. and Cambridge Energy Research Associates (CERA), suggests that the cost of new power plant construction in North America increased 27% in the past 12 months; 19% in the past 6 months alone.

Unveiled during the CERA Week Conference in Houston in February, IHS/CERA claim that a North American power plant that would have cost $1 billion in 2000 would, on average, cost $2.31 billion today. The PCCI tracks the costs of building coal, gas, wind and nuclear power plants indexed to year 2000.

“These costs are beginning to act as a drag on the power industry’s ability to expand to meet growing North American demand, and leading to delays and postponements in the building of new power plants,†according to CERA’s Candida Scott, adding, “The latest increases have been driven by continued high activity levels globally, especially for nuclear plants, with continued tightness in the equipment and engineering markets, as well as historically high levels for raw materials.â€

“As a result of all of this (construction) activity, lead times for engineered equipment has increased up to 50% in the last 6-12 months for some items, and as expected, prices have increased,†Scott added. “Overseas sourcing for many components further compounds cost pressures because, as costs of raw materials and shipping have risen, those increases are passed through to projects.â€

CERA Vice President Larry Makovich noted, “These cost pressures are a major strategy issue for power companies, and will affect timing and availability of new plants.†Looking forward, Scott said: “Unless there is a sudden and dramatic change in the industry, activity and market pressures should keep the PCCI at these levels, if not higher, for the next 12-18 months.

Even before the new index was unveiled, those in the know, already knew that everything was costing a lot more than it used to only a year or two ago and had some clues why this was happening. Now they have a new index to blame.

It is fair to say that the recent cost surge is even more pronounced in developing countries where pressures to build are even more pressing.

Leave a Reply

You must be logged in to post a comment.